On July 29, the U.S. Securities and Exchange Commission approved in-kind creation and redemption mechanisms for spot Bitcoin and Ethereum exchange-traded products (ETPs), marking a major shift in the structural framework underpinning crypto investment vehicles.

The decision replaces the cash-only model used in the first wave of crypto ETPs and aligns the regulatory architecture for digital asset funds with existing standards in commodity ETPs, such as those for gold. SEC Chair Paul S. Atkins, who assumed the role in April, described the move as part of a broader push to establish a “fit-for-purpose” crypto framework.

The SEC’s order also advanced a set of accompanying approvals including mixed BTC+ETH ETP applications, options on certain spot Bitcoin ETPs, and elevated position limits for these derivatives, up to the generic 250,000-contract threshold seen in traditional commodity markets.

These changes aim to harmonize the crypto derivatives ecosystem with that of long-established physical-asset ETPs. The initiative follows a wave of July filings from exchanges that had signaled regulatory readiness for in-kind workflows.

Unlike cash-based structures, where authorized participants (APs) submit fiat currency and rely on a fund’s agent to execute crypto purchases on open markets, in-kind mechanisms allow APs to deliver or receive the underlying asset, Bitcoin or Ethereum, directly.

This removes the need for fund-driven market trades and enables participants to use existing sourcing channels such as over-the-counter (OTC) desks, internal inventory, or borrowing arrangements. The result is typically lower transaction costs, tighter bid-ask spreads, and enhanced net asset value (NAV) tracking, as is well established in commodity ETFs like SPDR Gold Shares.

How in-kind creations and redemptions changes the model

The operational shift reconfigures primary market flows for arbitrage-focused APs. Under the in-kind model, they can short the ETF and source crypto directly for creation when premiums arise or redeem ETF shares for crypto when discounts emerge. This eliminates the execution lag and basis risk associated with cash settlements, creating cleaner hedging opportunities using CME futures. With open interest in CME Bitcoin derivatives near record highs in mid-2025, liquidity appears sufficient to support these changes.

The revised mechanism also alters how ETF flows interact with the spot crypto markets. In the previous model, fund-side purchases or redemptions introduced direct buy/sell pressure on exchanges, often influencing short-term price movements.

Now, APs can fulfill their asset obligations through OTC channels, thereby reducing the market footprint and potentially softening volatility during heavy flow days. This mirrors the bullion market’s use of OTC networks to settle gold ETP flows, limiting public order book stress.

Opening the door to massive inflows

As the infrastructure matures, several metrics will inform the market impact of the SEC’s decision. These include ETF premium and discount behavior relative to NAV, the spread between CME futures and spot prices, and on-exchange depth metrics on major USD trading venues. Analysts will be watching whether OTC market activity increases on high-creation days and whether public exchange liquidity becomes more resilient.

Mechanically, the shift may slightly reduce the direct exchange impact of ETF flows, dampening short-term price effects from primary market activity. However, the broader implications point toward increased scalability.

Lower costs, cleaner arbitrage, and enhanced hedging tools improve the vehicle’s appeal to institutional allocators. If these advantages translate into sustained net inflows, the upward pressure on spot Bitcoin and Ethereum demand could be substantial.

ETF flow data from earlier in 2025 already indicates a tight correlation between net inflows and Bitcoin price appreciation. By streamlining fund operations, the in-kind model lowers barriers for larger allocations and enables more predictable pricing behavior.

The addition of options and higher derivative limits further supports institutional positioning, echoing how access innovations helped scale commodity exposures in the past.

The regulatory overhaul effectively modernizes the infrastructure around crypto ETPs.

By permitting in-kind creations and redemptions, the SEC has created a pathway for demand to flow more efficiently into digital assets, reducing friction without altering the underlying thesis: flows move markets, and structure determines how much of that flow reaches the chain.

Ultimately, for Bitcoin ETFs to compete in size against the largest funds by AUM in the world, in-kind creations and redemptions are a necessity. The operational opportunities are immense, and the efficiency the change brings is essential to attracting additional capital.

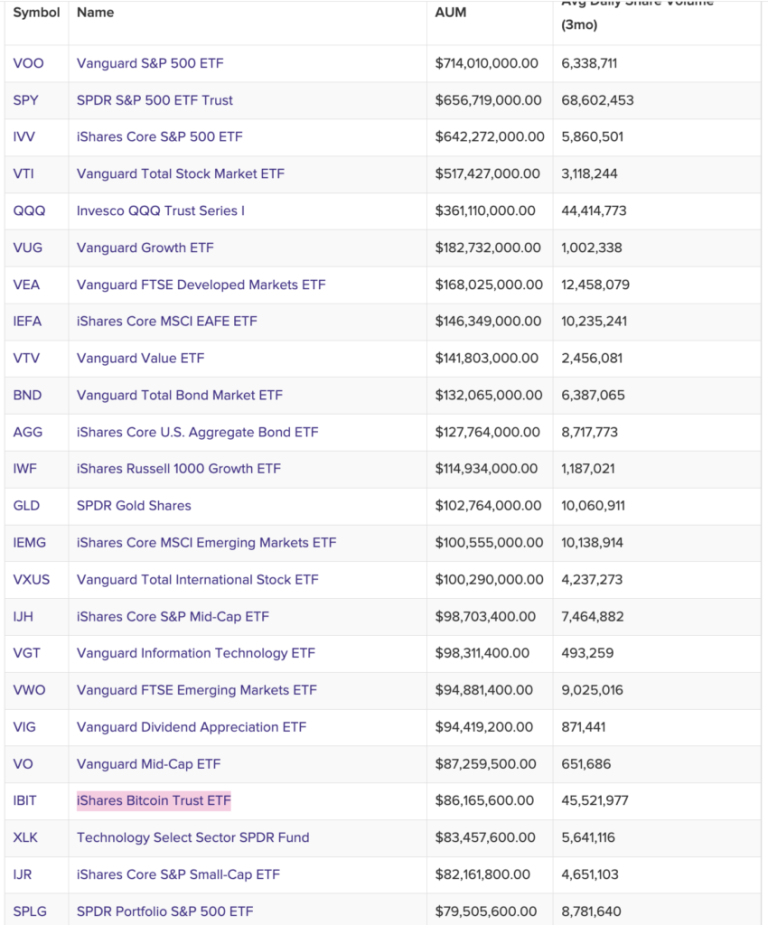

The largest ETF by AUM is Vanguard’s S&P 500 ETF (VOO), which holds $714 billion. By comparison, the largest spot crypto ETF, BlackRock’s (IBIT), currently controls $86 billion.

Could in-kind creations and redemptions allow Bitcoin ETFs to mature to a level comparable with VOO’s $700 billion giant? That requires a 10x explosion from where we’re at, but should Bitcoin price continue its ascension against the dollar, who knows what’s next.

At $200,000 Bitcoin, IBIT would already sit in the top 10 ETFs by assets even without another dollar of inflows. If inflows continue alongside BTC price appreciation for the next few years, a supply squeeze becomes almost inevitable.

The post SEC’s in-kind approval can spark HUGE $710 billion supply squeeze for Bitcoin ETFs appeared first on CryptoSlate.