A leveraged Ethereum position built by Jack Yi’s Trend Research continues to unwind under pressure.

The position, assembled through Aave’s lending protocol and reported to have reached roughly $958 million in borrowed stablecoins at its peak, has been shrinking through repeated defensive sales as Ethereum’s price declines.

On Feb. 4, Trend deposited another 10,000 ETH (approximately $21.2 million) to Binance to sell and repay loans, according to on-chain tracking profile Lookonchain.

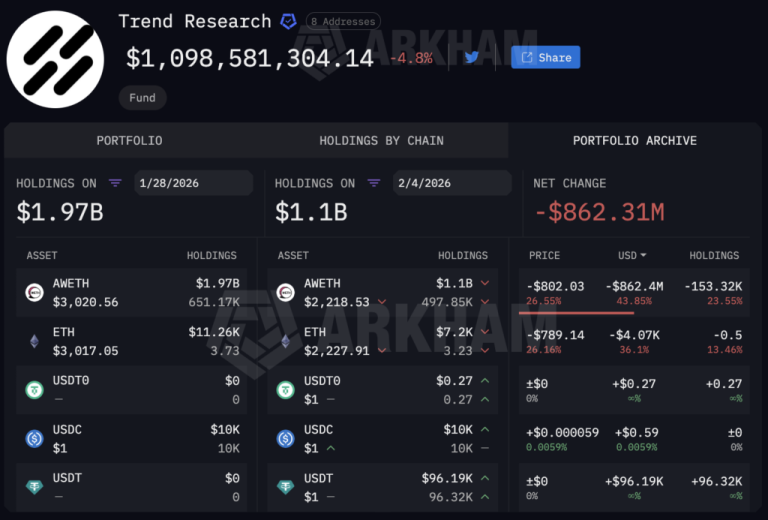

The position now holds 488,172 ETH, valued at roughly $1.05 billion at current prices.

The deleveraging began in early February, when Trend sold 33,589 ETH (roughly $79 million) and used $77.5 million in USDT to repay debt, thereby pushing the reported liquidation threshold from $1,880 to $1,830.

The Feb. 4 sale marks the latest step in a controlled retreat aimed at keeping the position above water as Ethereum trades lower.

The market watches as the mechanics of unwinding a billion-dollar leveraged bet during thin liquidity can trigger a cascade that moves the market faster than the flow itself would suggest.

What the numbers show

Lookonchain reported that Trend Research expanded its Aave-based leverage to approximately $958 million in borrowed stablecoins, backing holdings that peaked at roughly 601,000 ETH.

The position used Ethereum as collateral to borrow stablecoins, creating a loop where falling ETH prices reduce the collateral value. At the same time, the debt remains fixed, in a classic leveraged long structure.

Trend has now sold at least 112,828 ETH across multiple transactions since early February. The position has declined from approximately 601,000 ETH to 488,172 ETH, a reduction of approximately 19%.

At current prices near $2,150, the remaining position is valued at approximately $1.05 billion.

Arkham earlier estimated the position was down roughly $562 million in unrealized losses when liquidation risk first surfaced around the $1,800 level. Currently, the position is down $862 million since the end of January.

The data suggests multiple Aave positions with different liquidation thresholds, including one leg at approximately $1,558, indicating that the structure may be more complex than a single monolithic trigger.

The repeated sales show a strategy of staying ahead of forced liquidation by voluntarily reducing exposure. Each sale repays debt, thereby reducing the total outstanding debt and improving the health factor, which is the ratio of collateral value to debt value that determines liquidation eligibility.

However, each sale also locks in losses and reduces the remaining bet.

How Aave liquidations actually work

Aave liquidations don’t dump collateral onto the open market in one block trade.

Instead, they transfer collateral to liquidators, who repay a portion of the borrower’s debt and receive the seized ETH, along with a liquidation bonus. Liquidators then decide how and where to offload or hedge that ETH.

The liquidation process begins when a position’s health factor drops below 1. Aave’s close factor determines the amount of debt that can be repaid in a single liquidation event.

When the health factor is between 0.95 and 1, up to 50% of the debt may be liquidated. When the health factor falls below 0.95, up to 100% of the position may be liquidated.

This creates two regimes: a stepwise, manageable process if the position hovers near the threshold, or a cliff if the health factor plunges.

The potential liquidation amount depends on the remaining debt. If Trend has successfully reduced its debt through recent sales, the maximum liquidation flow is smaller than the initial $941 million to $958 million debt band.

However, the remaining 488,172 ETH still represents roughly $1.05 billion in collateral, enough to move markets if forced liquidation accelerates.

Ethereum’s 24-hour trading volume runs around $49 billion. A forced liquidation of even half the remaining position, roughly 244,000 ETH or $525 million at current prices, would represent about 1% of daily volume.

That sounds digestible until two reality checks complicate the math.

First, time compression matters. If liquidators need to offload quickly, within minutes or hours, the flow becomes a large share of short-horizon liquidity even if it’s a small share of 24-hour volume.

Second, liquidity is endogenous during stress. During leverage-driven selloffs, liquidity becomes fragile, potentially creating forced flows that move the price more than volume math suggests.

The cascade pathways

The market impact of a large Aave liquidation doesn’t come from a single sell order. It comes through three channels that can reinforce each other.

The first is direct liquidation disposal and hedging. Liquidators often hedge immediately by shorting perpetual futures, then unwind by selling seized ETH into spot or decentralized exchange liquidity.

This creates two-sided pressure: short futures and spot sales.

The second is a reflexive feedback loop. Spot price drops, oracle prices update, and more Aave positions cross the health factor threshold below 1, triggering additional liquidations.

Those liquidations put more ETH into liquidators’ hands, who sell or hedge, pushing the spot price lower. The cycle repeats.

The third is narrative and balance-sheet pressure. Even outside DeFi protocols, large holders facing unrealized losses may be prompted to engage in defensive selling to avoid worse outcomes.

Trend’s repeated sales demonstrate this dynamic.

What to watch

Three indicators signal whether this unwinds in a contained way or cascades.

First, the Aave health factor behavior. Trend’s repeated voluntary sales suggest that the health factor is actively managed and remains above the forced liquidation threshold.

If Ethereum’s decline accelerates and Trend can’t sell fast enough, the health factor could cross below 1.

Second, where the disposal prints. The Feb. 4 deposit of 10,000 ETH to Binance suggests centralized exchange order books are absorbing the flow. Watch for larger deposits or faster execution windows that could signal panic rather than controlled deleveraging.

Third, the broader liquidation environment. If Ethereum and the wider crypto market continue to experience elevated forced selling, the same flow exerts greater leverage on price because liquidity providers withdraw and order books thin.

The billion-dollar position at risk isn’t one trade. It’s a test of how DeFi liquidation mechanics, thin liquidity, and reflexive loops interact when leverage meets stress.

Trend Research’s controlled retreat shows the strategy for staying ahead of forced liquidation.

Whether that strategy succeeds depends on how fast Ethereum falls and how much liquidity remains in the market to absorb the flow.

The post Ethereum faces billion dollar sell pressure as top crypto fund faces $862M high stakes liquidation risk appeared first on CryptoSlate.