Bitcoin retreated below the closely watched $70,000 threshold, leading a broad selloff in digital assets that has erased over $1 billion in trading positions.

According to CryptoSlate’s data, the world’s largest cryptocurrency fell to lows not seen since the November 2024 election, dragging the wider market into the red.

Ethereum slid 7% to around $2065, while XRP, a recent outperformer, dropped more than 14% to $1.35.

Other major tokens, including Cardano, BNB, Solana, and Dogecoin, posted similar losses, succumbing to a wave of selling pressure that has firmly gripped the asset class.

The slump marks the industry’s weakest performance since the onset of the second Donald Trump administration, reflecting a rapid shift in sentiment from post-election euphoria to risk-off capitulation.

Unlike prior drawdowns driven by discrete shocks, traders say this move reflects a grinding erosion of confidence as capital rotates toward equities and commodities, leaving digital assets increasingly sensitive to negative headlines.

Samson Mow, founder of Bitcoin-focused firm Jan3, said the selloff felt especially painful because of its asymmetry.

In comments posted on social media, Mow argued that Bitcoin has struggled to benefit from risk-on narratives but remains exposed to broader risk-off moves. When fears around artificial intelligence valuations emerge, he said, crypto sells off, and when metals retreat, crypto falls alongside them.

Bitcoin price wobbles lead to liquidation cascade

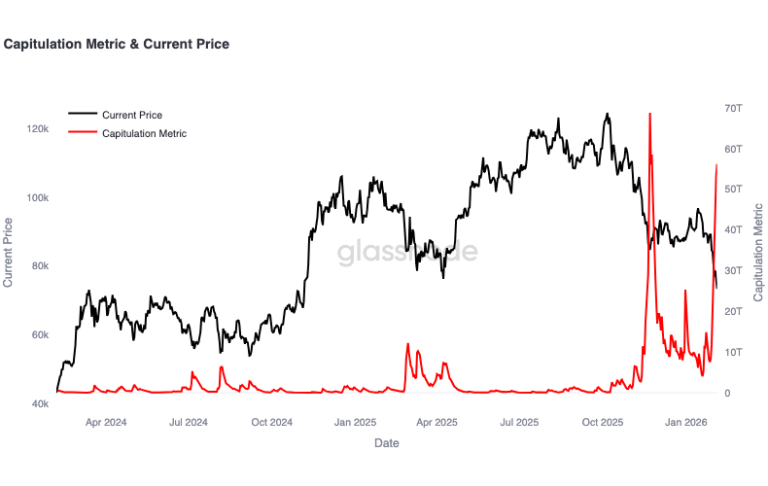

On-chain data suggest the decline has been accompanied by a sharp increase in forced selling.

Glassnode reported that Bitcoin’s capitulation metric recorded its second-largest spike in the past two years, signaling a rapid escalation in liquidations and position unwinds. Such stress events typically coincide with accelerated de-risking and heightened volatility as traders reset exposure.

Indeed, the price drop triggered a wave of liquidations in derivatives markets.

Data from Coinglass indicate that more than $120 million in positions were liquidated within a single hour as prices fell through key technical levels.

Long positions accounted for the majority of the damage, with roughly $116 million liquidated, while short positions lost about $6 million.

Bitcoin-linked contracts bore the brunt of the losses, with liquidations totaling more than $86 million. Ethereum traders closed approximately $16 million in positions, while bets tied to Solana and the HYPE token were liquidated for approximately $3 million and $6 million, respectively.

Over a 24-hour period, total liquidations reached approximately $1.06 billion, underscoring the scale of leverage embedded in the market.

Long positions accounted for nearly $900 million of that total, highlighting how quickly bullish positioning can unwind when prices move sharply lower.

The post Bitcoin crashes below $70,000 critical support as XRP hit hardest, liquidating traders for over $1B appeared first on CryptoSlate.